Disclaimer: This article is for informational purposes only and does not constitute legal or tax advice. Real estate and wholesaling laws in Texas are subject to change. PropStream does not provide legal guidance. Consult a qualified professional to ensure compliance with current Texas regulations.

The Texas housing market isn’t cooling off. It’s recalibrating. For real estate wholesalers in 2026, that shift matters more than ever. Texas remains one of the most compelling real estate markets in the U.S. Even as nationwide home sales hovered near multi-decade lows in 2025, Texas reclaimed the top spot on U-Haul’s 2025 Growth Index as the state with the most inbound moves in the nation, the seventh time in the past decade, highlighting continued migration from high-cost states like California and New York.

While statewide median home prices have cooled and stabilized compared to the blistering growth of previous years, they’re expected to grow at a moderate pace in 2026, and markets are balancing out as inventory increases.

This environment presents a mix of steady demand, more negotiable sellers, and diverse markets, from major metros like Dallas-Fort Worth, Houston, and Austin, to emerging secondary cities with rising investor interest. With the right tools and data, wholesalers who understand the rules and trends can still find strong opportunities in Texas today.

Table of Contents |

Is Wholesaling Real Estate Legal in Texas?

As of 2026, wholesaling in Texas is structured around the transfer or assignment of a contractual or equitable interest, rather than the marketing or sale of the property itself without proper licensing.

While wholesalers may profit from assigning a purchase contract or option, they cannot act as brokers or publicly market a property they do not own unless they hold an active Texas real estate license. Texas places strong emphasis on disclosure and accuracy. Offering a property for sale without ownership or misrepresenting the nature of the interest being sold is considered brokerage activity and requires licensure.

These standards were formally reinforced through Senate Bill 2212, which amended Texas law to codify Texas Real Estate Commission (TREC) rules around the sale of equitable interests. When these disclosure and “truth in advertising” requirements are followed, the practice commonly known as wholesaling remains legal in Texas.

Disclaimer: This content is for informational purposes only. PropStream does not provide legal advice. Consult a qualified legal professional regarding compliance with Texas real estate laws.

What Is Real Estate Wholesaling?

Real estate wholesaling is a strategy that focuses on connecting motivated sellers with active buyers, rather than purchasing properties for long-term ownership. Instead of buying a home outright, a wholesaler identifies an opportunity, secures the right to purchase it, and then transfers that right to another investor for a fee.

In practice, the wholesaling process typically involves:

- Identifying homeowners who may be open to a quick or off-market sale

- Negotiating a purchase agreement that leaves room for an investor's profit

- Passing the contract to a cash buyer who completes the transaction

Because wholesalers are dealing in contracts rather than properties, the strategy requires far less capital than traditional investing. There’s no need for a mortgage, rehab budget, or long-term financing in most cases, which makes wholesaling an accessible entry point for beginners.

Wholesaling also offers hands-on exposure to how real estate deals actually work. New investors gain experience analyzing properties, negotiating terms, and building relationships with buyers, all while learning how different markets and regulations impact transactions.

Pro Tip: If you’re new to the process, signing up for PropStream Academy’s free Introduction to Wholesaling course is a great way to build confidence and understand the basics before tackling your first deal.

6 Key Factors to Keep In Mind When Wholesaling Real Estate in Texas

Below are key considerations to keep in mind when wholesaling real estate in Texas. These guidelines help you operate within state regulations while building a sustainable and compliant wholesaling business.

1. Understand the Role of Contracts and Ensure Help from a Legal Counsel

Every wholesale deal starts and ends with a contract. In Texas, wholesalers are typically transferring or assigning a contractual or equitable interest, not selling the property itself. Small errors in contract language can lead to disputes or compliance issues, especially around disclosure and assignment rights.

Key points to remember:

- You are selling your contractual interest, not the property

- Your contract should clearly allow assignment

- Sellers should understand that the contract may be assigned

- Working with a real estate attorney familiar with Texas wholesaling can help ensure your agreements are enforceable

Avoid relying on generic online templates. A properly structured contract helps protect your role, clarify expectations, and reduce legal risk.

Related read: What Should a Wholesale Real Estate Contract Include?

2. Build and Maintain a Strong Cash Buyer Network

Having cash buyers ready before you secure a property can significantly reduce fallout and speed up closings. The more aligned your buyers are with your target markets and deal types, the easier it becomes to move contracts quickly and consistently.

Effective ways to build a cash buyer network include:

- Attending local real estate investor meetups and clubs across Texas markets.

- Participating in private online investor communities and social groups.

- Maintaining direct relationships with landlords, flippers, and repeat investors.

- Using data tools like PropStream to identify active investors through cash purchases and rental ownership.

Pro Tip: Build your buyer list before locking up deals. PropStream can help you spot investors already buying in your target areas, allowing you to focus outreach on buyers most likely to close.

3. Understand Assignment vs Double Closings in Texas

Texas wholesalers typically exit deals using either contract assignments or double closings. Both methods are legal when structured properly, but each serves a different purpose depending on the deal, the seller’s expectations, and the level of privacy required.

|

Assignment Contract |

Double Closing |

|

You transfer your contractual interest to another buyer |

You purchase the property, then resell it to the end buyer |

|

Faster execution with minimal upfront costs |

Higher costs due to two closings |

|

Requires clear disclosure and seller awareness |

Provides greater privacy and discretion |

|

Some sellers or buyers may push back on assignments |

Requires access to short-term or transactional funding |

Experienced wholesalers often rely on assignments to move deals quickly and build volume. Double closings are typically reserved for situations where sellers or buyers are uncomfortable with assignments, or when greater control and confidentiality are needed to secure the deal.

4. Build a Multi-Channel Approach to find Motivated Sellers

Motivated sellers respond differently depending on timing, situation, and communication preference. A multi-channel approach helps you stay visible, adapt to seller behavior, and create more opportunities to start quick conversations.

Common channels wholesalers use to reach motivated sellers include:

- Direct mail: Effective for reaching homeowners who prefer tangible communication, especially in probate or long-term ownership situations

- Driving for dollars: Identifies visible property distress and uncovers opportunities not yet listed or marketed

- Online investor and community referrals: Leverages word-of-mouth and local relationships to surface off-market leads

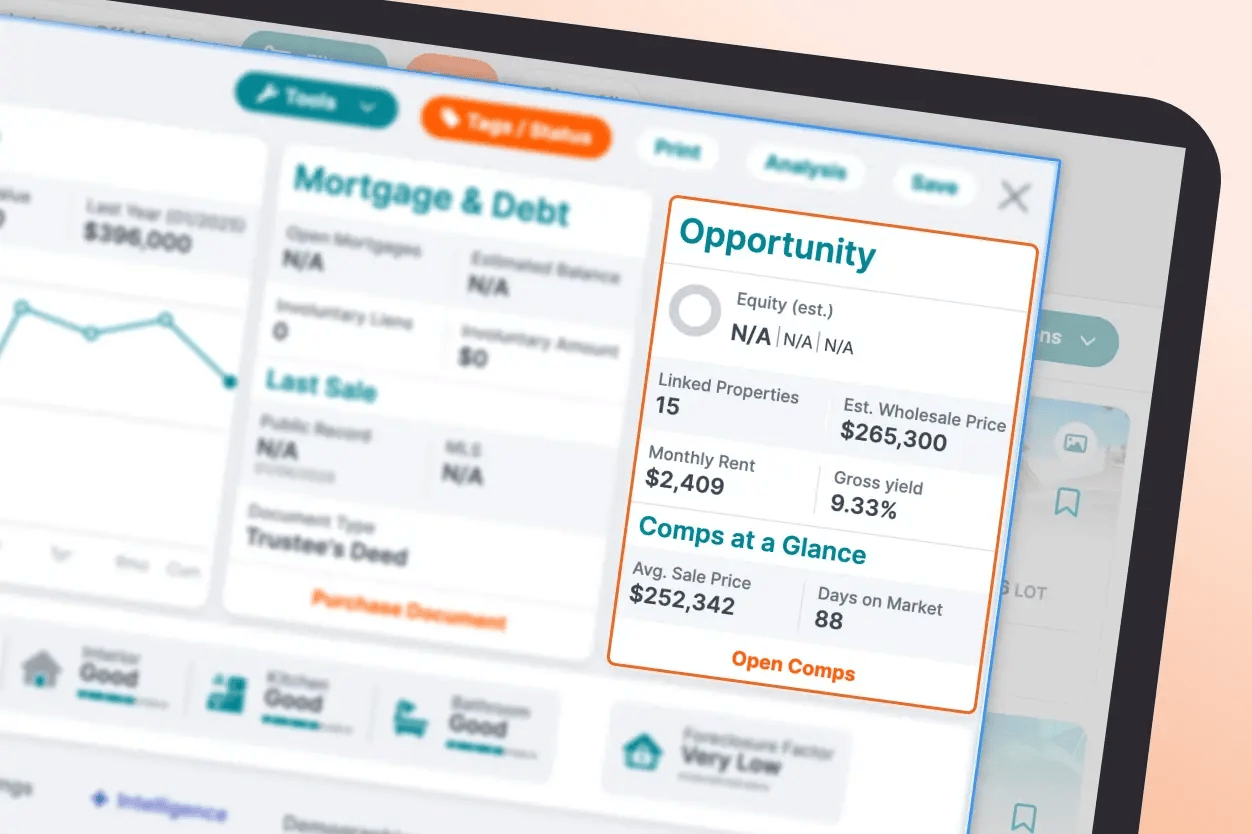

While using multiple channels increases reach, success still depends on who you’re contacting. Platforms like PropStream help wholesalers focus their outreach by identifying motivated seller indicators such as equity, ownership length, financial distress, and absentee ownership.

Pro Tip: Using PropStream Intelligence, wholesalers can view the Estimated Wholesale Value of a property, helping them quickly gauge deal potential before investing time in deeper analysis.

5. Taxes and Business Structure

Wholesale assignment fees in Texas are typically treated as ordinary income, not capital gains. While Texas does not have a state income tax on individuals, federal taxes still apply, and poor recordkeeping can lead to surprises.

Best practices include:

- Tracking marketing, data, and operational expenses

- Structuring your business properly (often via an LLC)

- Working with a CPA who understands real estate investing

Planning ahead helps protect profits and supports long-term scalability.

Related Read: Wholesaling Real Estate Taxes: A Beginner’s Guide

6. Understanding Texas Mini-TCPA Rules for Wholesalers

As you scale outreach in Texas, cold calling and text messaging often become essential. That makes compliance with the Texas Mini-TCPA, which was expanded and updated in September 2025, critical from the start. These state-level rules build on federal TCPA requirements and add stricter guidelines around how, when, and to whom outreach is permitted.

Key compliance best practices include:

- Obtaining proper consent where required before initiating calls or texts

- Providing clear opt-out options in messaging campaigns

- Maintaining accurate records of outreach activity, including calls, texts, and consent

- Using dialing and messaging tools designed with compliance safeguards

The penalties for getting this wrong can be severe. Violations of Texas Mini-TCPA rules may result in enforcement actions by the Texas Attorney General, with fines of up to $5,000 per violation.

Make sure to use a TCPA-compliant outbound dialer such as BatchDialer when reaching out to prospects and managing consent, DNC scrubbing, call tracking, and phone number reputation. When paired with accurate lead data from PropStream, wholesalers can focus outreach on the right prospects, reduce unnecessary contact attempts, and scale campaigns with greater confidence.

Also Read: How Wholesalers Use BatchDialer to Scale Outreach

Disclaimer: This content is for informational purposes only and does not constitute legal advice regarding the Telephone Consumer Protection Act (TCPA) or Texas Mini-TCPA regulations. PropStream does not provide legal guidance. Laws and enforcement standards may change. Consult a qualified legal professional to ensure compliance with applicable federal and Texas outreach and communication laws.

Final Thoughts on Wholesaling Real Estate in Texas

Texas remains one of the strongest states for wholesaling real estate. With a population of more than 30 million and continued growth, housing demand shows no signs of slowing.

While the state has clear regulations, it still allows wholesalers plenty of room to operate, especially those who understand the rules, build strong buyer networks, and use data to focus on the right opportunities.

With the right approach and tools like PropStream, finding and evaluating wholesale opportunities becomes more efficient and more predictable. With custom filtering options and access to 20 pre-built Lead Lists, investors can quickly identify motivated sellers across Texas markets and focus their outreach where it matters most.

Find your next Wholesaling opportunity in Texas with PropStream.

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

Is wholesaling real estate legal in Texas?

Yes. Wholesaling is legal in Texas when you assign or transfer a contractual interest and clearly disclose your role. Marketing a property you don’t own requires a real estate license.

Do you need a license to wholesale in Texas?

No. A license isn’t required, but unlicensed wholesalers must avoid brokerage activities and follow strict disclosure rules.

What’s the difference between an assignment and a double closing?

An assignment transfers your contract to another buyer, while a double closing involves buying and immediately reselling the property. Assignments are faster; double closings offer more privacy.

How do wholesalers find motivated sellers in Texas?

Most use a mix of outreach channels and data. Tools like PropStream help identify motivated sellers based on equity, ownership length, and distress indicators.

How are wholesale deals taxed in Texas?

Wholesale fees are typically taxed as ordinary income. Texas has no state income tax, but federal taxes still apply. Learn more about Wholesaling Real Estate Taxes here.

What happens if you violate Texas Mini-TCPA rules?

Penalties can reach $5,000 per violation, with additional statutory damages for non-compliant calls or texts. Using compliant dialing tools is essential.

Subscribe to PropStream's Newsletter

*PropStream engages an independent third party to perform skip-tracing.