Disclaimer: PropStream does not offer investment advice. This article is for informational purposes only. Consult a financial professional before investing in real estate.

|

Key Takeaways:

|

Owning real estate can be a powerful way to build long-term wealth. But when you’re just starting out, you may have a limited budget that keeps you from buying in the top U.S. markets.

That’s why we compiled a list of the most affordable real estate markets for investors in 2026. Read on to learn more about them, what they have to offer, and how to invest in them.

Table of Contents |

Top Affordable Real Estate Markets for New Investors in 2026

The markets below were each chosen for their below-average home prices, strong rental demand, stable job sectors, and overall low barriers to entry.

Midwest: The Most Reliable Cash-Flow Region

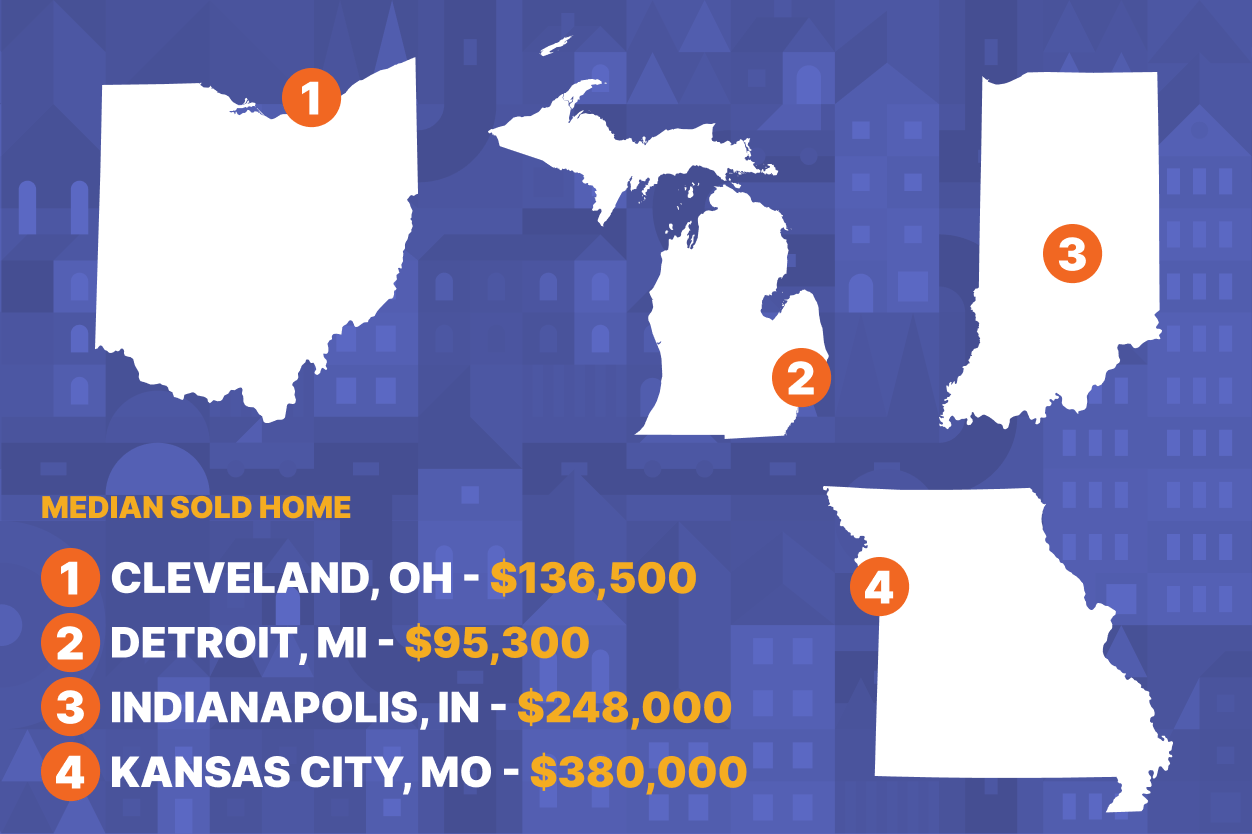

1. Cleveland, OH

Cleveland, Ohio, is one of the most affordable metros in the U.S., with a median sold home price of $136,500. It also has a relatively strong rent-to-price ratio of 10.44, compared to a national rate of 23.02 (the lower the rate, the more rent you collect relative to property value).

Meanwhile, the city has strong blue-collar manufacturing and healthcare sectors, creating job stability for many in the region. Investment strategies that may be particularly lucrative include buying and holding long-term rentals and Section 8 housing.

2. Detroit, MI

Though Detroit, Michigan, has significantly shrunk since its peak in 1950, it’s starting to grow again due to the city’s revitalization efforts. Still, home prices are low compared to the rest of the U.S. The median sold home price is just $95,300.

Detroit also offers relatively high cash flow potential. For example, assuming you buy a $95,300 property with a 30-year fixed mortgage at a 6% interest rate and with a 20% down payment, you could expect a monthly payment of about $457. By collecting the city’s median rent of $1,091, you’d be left with a monthly cash flow of $634 (before property expenses, taxes, insurance, etc.)

3. Indianapolis, IN

Indianapolis, Indiana, has a stable housing market and relatively landlord-friendly state laws, making it a great city for real estate investors. Its strong job market and steady population growth help keep occupancy and rents up. Plus, 43.8% of the city’s homes are rented, among which are a good mix of single-family and small multifamily rentals.

4. Kansas City, MO

Kansas City is relatively affordable, but home prices are steadily appreciating. In October 2025, the metro’s median home listing price was $380,000, up 0.8% from the same time last year.

Part of what drives renters to Kansas City is its diverse employment opportunities. Top employers include the Food and Drug Administration, T-Mobile, Ford Motor Inc., Tyson Foods, UMB Financial Corporation, and Garmin International, Inc.

Popular investment strategies include long-term buy-and-hold investing and the BRRRR method (buy, rehab, rent, refinance, and repeat).

Southeast: Growing Demand + Still Affordable

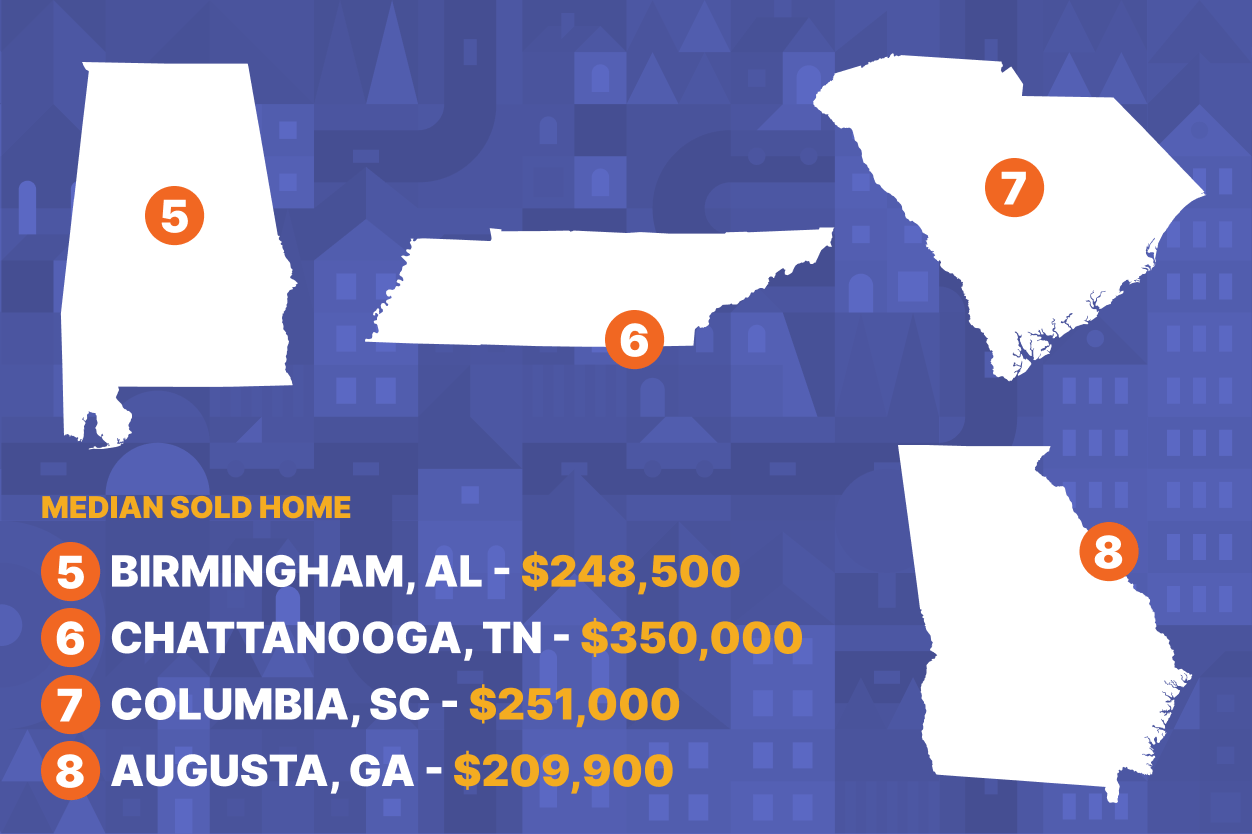

5. Birmingham, AL

Birmingham, Alabama, is known for its rich history, but it also offers real estate entry prices well below the U.S. median. The median sold home price in the city is $248,500.

Meanwhile, Birmingham enjoys landlord-friendly state laws and solid rental demand, with 53.2% of its homes occupied by renters. As a result, the city can be good for new investors who want to break into the long-term rental market.

6. Chattanooga, TN

Chattanooga, Tennessee, offers a more affordable alternative to investing in Nashville (the state’s capital and most populous city). For example, the median sold home price in Chattanooga is $350,000, compared to $464,900 in Nashville.

At the same time, Chattanooga offers balanced appreciation and steady cash flow. This is partly due to its outdoor attractions and an influx of tech workers to nearby cities, which is pushing people to move to Chattanooga.

7. Columbia, SC

As the South Carolina state capital, Columbia benefits from stable government employment. It also has a thriving health care and social assistance industry that makes up 14% of the city’s economy and over 6,400 employees who work at the University of Carolina.

Consequently, real estate investors enjoy consistent rental demand, particularly from the university student population. Affordable single-family homes and duplexes also tend to do well.

8. Augusta, GA

Augusta, Georgia, is a small city supported by strong military defense, healthcare, and education industries. Top employers include the U.S. Army Cyber Center of Excellence & Fort Gordon (29,252 military and civilian employees), Augusta University (6,775 employees), NSA Augusta (6,000 employees), and Augusta University Hospitals (5341 employees).

These and other jobs drive a consistent need for rentals in the city, minimizing vacancies. Meanwhile, home values are generally lower than those in nearby Atlanta suburbs. The median sold home price in Augusta is $209,900.

Also read: Buying Your First Rental Property: A Step-by-Step Guide for Beginners

South & Sun Belt Submarkets (Affordable Alternatives to Big Cities)

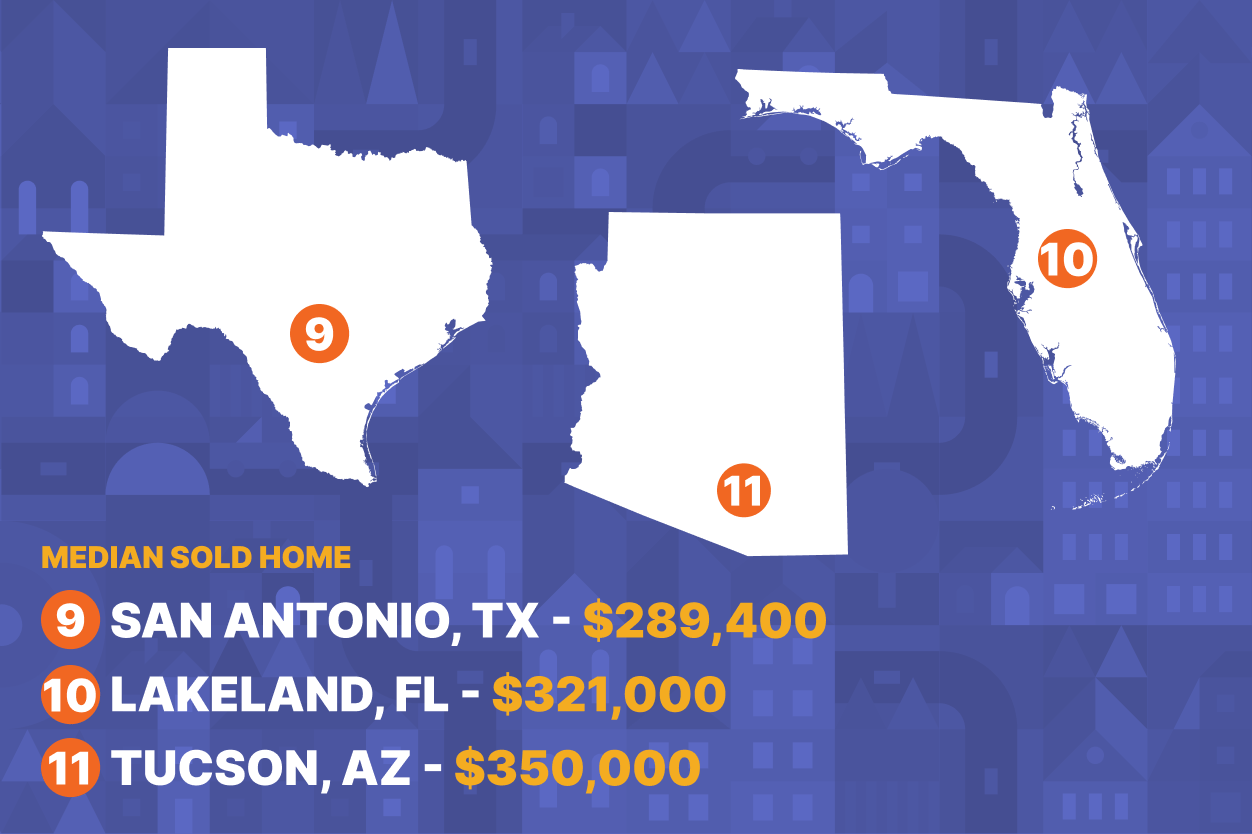

9. San Antonio, TX

Compared to other major Texas cities, San Antonio is relatively affordable. The median sold home price is $289,400, compared to $351,600 in Dallas and $540,000 in Austin.

Furthermore, San Antonio is one of the fastest-growing cities nationwide. It ranked fourth for new residents gained from 2023 to 2024, growing by 23,945 residents during that period. This has helped push up demand for long- and mid-term rentals.

10. Lakeland, FL

Lakeland is located in Central Florida’s growth corridor. It has a relatively affordable median sold home price of $321,000, compared to $410,000 in nearby Tampa and $400,000 in Orlando.

Part of what makes Lakeland an attractive market for rental investors is its high rental demand. According to the U.S. Census Bureau, 42.6% of homes are occupied by renters, significantly higher than the 32% statewide rate.

11. Tucson, AZ

Compared to Phoenix, Tucson is a more accessible Arizona market for real estate investors. The median home sold price is $350,000, compared to $465,000.

At the same time, the city enjoys steady property appreciation and strong rental activity. This is partly due to the city’s universities (The University of Arizona) and military presence (Davis-Monthan Air Force Base), which stabilize housing demand.

What Makes These Cities Attractive to New Investors

Here are the top reasons these housing markets may be ideal for first-time investors:

- Low purchase prices equal lower risk. Entry-level homes stretch your dollars further and minimize upfront capital.

- Reliable rental demand. Many of these cities are anchored by strong workforce renters, meaning fewer vacancies and steadier monthly returns.

- Job diversity that supports stability. From healthcare to tech to government to manufacturing, these metros aren’t dependent on a single employer.

- Landlord-friendly environments. Midwest and Southeast markets often offer simpler regulations, quicker evictions, and investor-friendly laws.

- Balanced appreciation + cash flow. Unlike pricey coastal markets, these cities let investors access both steady rent and long-term value growth.

Together, these factors may offer a lower barrier to entry and a more predictable investing experience for beginners, making these markets potentially attractive options to explore when building a portfolio in 2026.

How PropStream Helps You Invest in These Markets Remotely

The best part is you don’t have to live in any of these markets to invest in them. With PropStream, you can find, analyze, and pursue properties in any market.

For example, PropStream lets you analyze neighborhoods using value comps and rent estimates. You can then search our database’s 160+ million property records with 165+ filters to find discounted opportunities. Some helpful filters include absentee owners, vacant, high equity, and pre-foreclosure. Stack multiple filters to build the most targeted lead lists.

From there, you can evaluate each property lead before skip tracing the owner’s contact information and launching an email or postcard marketing campaign directly within PropStream.

| If you are New to investing? Start with the free Real Estate Investing Basics course from PropStream Academy. |

Ready to explore these high-opportunity, affordable markets? Use PropStream today to compare neighborhoods, analyze rentals, and find discounted off-market properties nationwide.

|

Notes on sources:

|

Turn affordability into opportunity with PropStream!

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

How much money do I need to start investing in these real estate markets?

With median home prices ranging from $95,300 (Detroit) to $380,000 (Kansas City), you could potentially start with as little as a few thousand dollars for a down payment on the most affordable properties, though you’ll also need to budget for closing costs and potential repairs.

Can I invest in these markets even if I don’t live there?

Yes, long-distance real estate investing is increasingly common, and tools like PropStream make it possible to analyze neighborhoods, research properties, and find opportunities from anywhere.

Which investment strategy works best in these markets?

Long-term buy-and-hold rentals tend to perform well across all these markets, though strategies like BRRRR (buy, rehab, rent, refinance, repeat) and buying Section 8 housing can also be effective, depending on the city and neighborhood.

What are the biggest risks when investing in affordable markets?

Lower-priced markets can come with challenges like higher maintenance costs, more tenant turnover, neighborhood quality concerns, and slower appreciation compared to higher-priced markets, making thorough due diligence essential.

Subscribe to PropStream's Newsletter

*PropStream engages an independent third party to perform skip-tracing.