Disclaimer: PropStream does not offer financial or legal advice. This article is for informational purposes only. Do your own research and consult financial and/or legal professionals before pursuing a career in real estate investing.

|

Key Takeaways:

|

Real estate is a long game. The best investors learn from experience, stick to a proven strategy, make data-informed decisions, and don’t expect to get rich quickly. But over time, the consistency and patience tend to pay off. Read on to learn how to set yourself up for long-term success.

Why Real Estate Investing Is a Long-Term Career, Not a Shortcut

The prospect of a quick profit can be enticing, but it’s rarely how successful real estate investors operate. Instead, they focus on developing the skills, systems, and relationships that will take them the distance, outpacing market cycles and capitalizing on compounding returns. In short, it’s the patient investor who succeeds in real estate, not the one looking to get rich quickly.

#1: Start With Education and Market Understanding

Before investing your hard-earned money in real estate, ensure you have a clear understanding of the asset and market you’re targeting. For example, if you plan to buy property in your local neighborhood, research average home values and current supply and demand trends. The more informed you are, the better long-term investment decisions you’ll make.

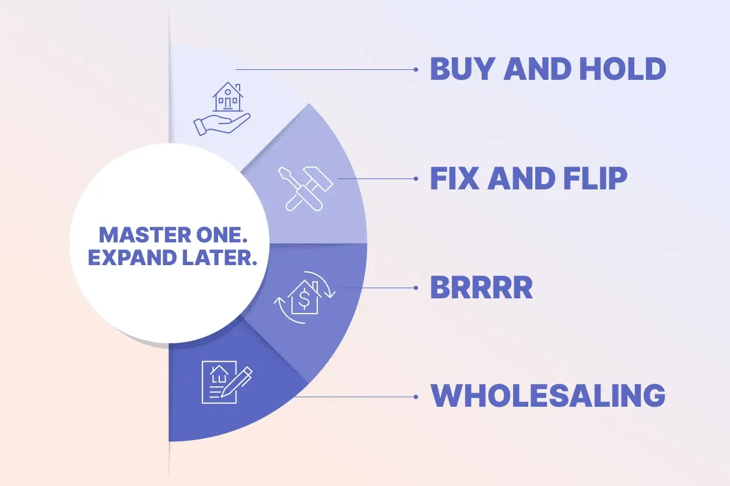

#2: Choose a Core Strategy Before Expanding

There are many real estate investing strategies. Choose one that aligns with your long-term goals and avoid picking or switching between too many (i.e., succumbing to “shiny object syndrome”). Here are some popular strategies to consider:

- Buy and hold: Buy property for the monthly cash flow while building equity over time.

- Fix and flip: Buy distressed homes at a discount, renovate them, and sell for a profit.

- BRRRR: Buy a property, rehab it, rent it out, refinance to pull out your sweat equity, and repeat the process by using the cash to buy another property.

- Wholesaling: Put a property under contract and assign it to another investor for a fee.

Start with one strategy. Then, once you’ve mastered it, you can explore others to diversify.

Pro Tip: PropStream Academy offers a Free Real Estate Investing Basics course package designed to help you learn the fundamentals step by step.

#3: Learn to Analyze Deals Consistently

Deal analysis is an essential real estate investing skill. It’s how you know when to seize an opportunity and when to pass on one. Failing to understand the difference could be detrimental.

For instance, learn how to value a property’s current and after-repair value (ARV), potential rental income, and estimated renovation and holding costs. From there, you can calculate profit margins and various return metrics like cap rate, cash-on-cash return, and internal rate of return (IRR). These then enable you to compare deals and benchmark them against return targets.

Over time, consistent analysis breeds competence, which builds your confidence and speed.

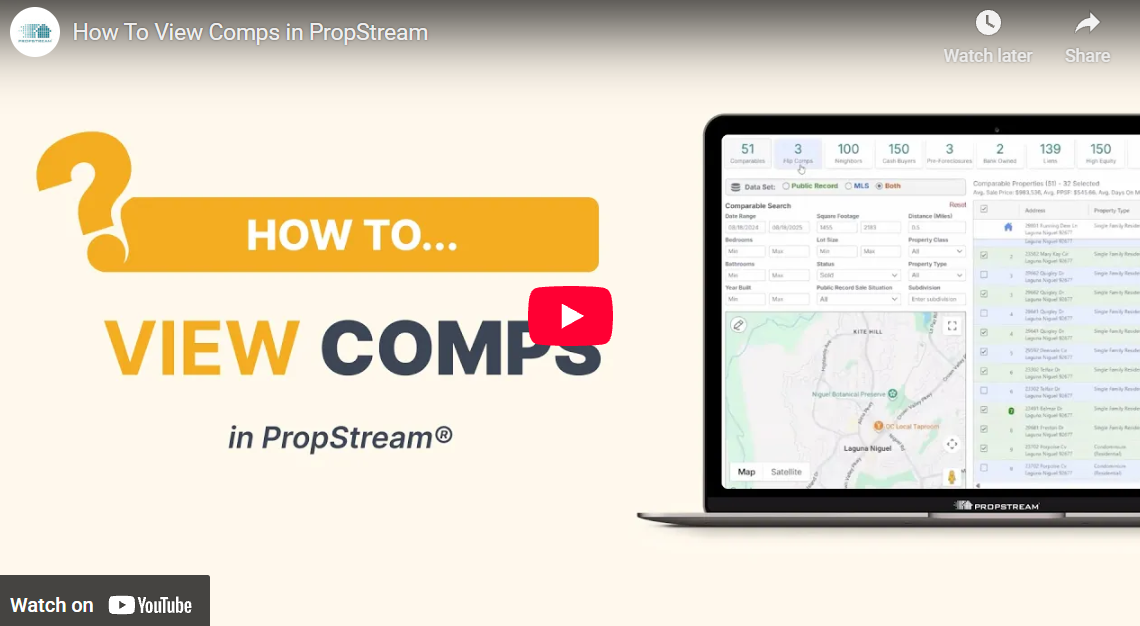

Pro Tip: With PropStream, you can quickly estimate property values based on similar nearby properties that recently sold (aka “comps”), review property ownership and transaction history, and estimate equity based on the owner’s mortgage information.

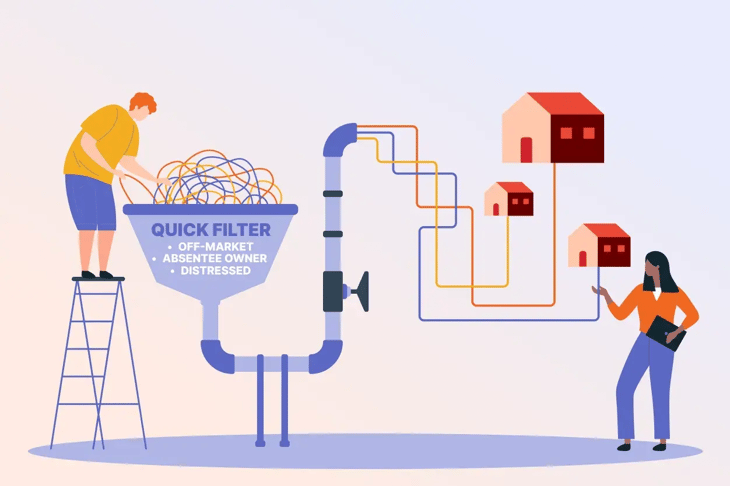

#4: Use Property Data Wisely to Identify Real Opportunities

Your deal analysis is only ever as good as your data. Use a reliable real estate data provider like PropStream to ensure you’re working with accurate information. We aggregate the latest data from public records, multiple listing services (MLSs), and other sources to help you filter out high-risk deals and focus your time and capital on opportunities that fit your investment criteria.

For example, you can apply 165+ different filters to your PropStream searches to narrow in on profitable markets and different lead profiles, such as off-market leads, absentee, and distressed owners.

Also read: Top 9 Ways To Find Off-Market Real Estate Opportunities

#5: Build Repeatable Deal Flow Systems

It’s not enough to strike one good deal. To maintain a long-lasting real estate career, you must maintain consistent deal flow. This requires a lead funnel that regularly generates leads. The more leads you capture, the more offers you can make and the more deals you can close.

With PropStream, you can create systems that run in the background while you focus on offers and follow-up. For example, you can:

- Save searches as dynamic Lead Lists, such as pre-foreclosures with high equity or absentee owners in specific zip codes. These lead lists automatically update as new properties meet your criteria.

- Stack filters to create niche lead angles, like failed listings with long ownership duration, helping reduce competition.

- Skip trace and launch outreach from the same platform, keeping property data, contact info, and campaigns connected.

- Track lead activity, so you know which lists produce deals and which need refinement.

The result is not just more leads, but predictable deal flow that you can manage and scale over time.

#6: Use Outreach Tools to Scale Smarter

As your real estate business grows, outreach quickly becomes the bottleneck. However, the right tech stack can help you overcome them.

For example, if you spend a lot of time cold calling leads, consider investing in a multi-line dialer like BatchDialer. It lets you call up to five phone numbers simultaneously to boost your productivity. Similarly, PropStream’s email and postcard marketing features let you send messages to thousands of leads with the click of a button.

Also read: Why Every Real Estate Business Needs a Dedicated Dialer in 2026

#7: Build Relationships and Credibility Over Time

Any real estate transaction involves trust between agents, sellers, buyers, and other stakeholders. As a result, your long-term success as an investor depends on building strong relationships with others. The better your reputation, the more opportunities will come your way.

#8: Manage Risk and Protect Longevity

Like any investment, real estate comes with risks. However, you can minimize them by not overleveraging yourself, avoiding emotional decision-making, and planning for current and upcoming market cycles. In short, treat investing like a business, not a gamble.

Pro Tip: Hedge your risk by performing due diligence with PropStream. Our platform has data on over 160 million properties nationwide, such as deeds, liens, loan documents, and more.

#9: Know When and How to Scale Your Investing Efforts

Knowing when to scale your real estate investments can be a challenging task. You must strike the right balance between keeping your capital working and not overextending yourself financially.

To that end, actively monitor your portfolio’s ROI and keep an eye out for opportunities with outsized return potential and minimal risk. That way, you can deploy capital strategically. This applies to properties, as well as marketing, software, and other investments that will help you grow.

How PropStream Supports Long-Term Real Estate Investors

Ultimately, building a successful real estate investing career takes time, discipline, and the right information. Whether you’re a total beginner or a seasoned pro, check out the quick tutorial to learn more about the platform.

PropStream can help with:

- AI-driven market research across 160+ million properties, using PropStream Intelligence to analyze equity, ownership length, distress signals, and market trends from MLS and nationwide listing data.

- Motivated lead discovery with 165+ filters and 20 pre-built Lead Lists, including Failed Listings, Pre-Foreclosures, Vacant Properties, and Absentee Owners, with saved searches that update as new opportunities appear.

- Accurate comps and deal analysis from multi-sourced data, enabling ARV evaluation, price trend analysis, and neighborhood insights tied directly to each property.

- Lower risk through verified property and ownership data, including equity position, mortgage details, lien information, and transaction history before making offers.

- Free, on-demand education through PropStream Academy, with on-demand courses covering industry terminology, core investing strategies, and step-by-step instruction on using the PropStream platform.

At every stage of the real estate investment lifecycle, our platform gives you the tools you need to make smarter and faster decisions.

Invest in Real Estate with PropStream today!

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

How do I start investing in real estate with little experience?

Begin by educating yourself about your local market, choosing an investing strategy that aligns with your goals, and using data tools like PropStream to analyze your first deals.

What’s the best real estate investing roadmap for beginners?

Start with market research, select a strategy (e.g., buy-and-hold or wholesaling), learn how to analyze deals, generate leads, and gradually scale as you gain experience and competence.

Is wholesaling real estate a good starting point for beginners?

It can be. Wholesaling requires minimal capital and lets you learn deal analysis, negotiation, and market dynamics while building your network.

How long does it take to build a real estate investing career?

Building a sustainable real estate investing business can take years of consistent effort, though timelines can vary by strategy, market conditions, available capital, and how fast you learn.

What makes long-term and short-term real estate investing different?

Long-term real estate investing focuses on building repeatable systems, steady cash flow, and equity appreciation over time, while short-term strategies prioritize quick profits.

What are the biggest mistakes new investors make when trying to build a real estate investing career?

Common mistakes include switching between strategies too quickly, making emotional decisions, overleveraging, skipping due diligence, and expecting immediate results.

Subscribe to PropStream's Newsletter

*PropStream engages an independent third party to perform skip-tracing.