Try PropStream for 7 Days Free!

Disclaimer: PropStream does not offer legal advice. This article is for educational purposes only. Consult a legal professional before contacting homeowners with notices of default.

|

Key Takeaways:

|

In a slow housing market, property and seller leads can be scarce. Real estate professionals who want to maintain a steady deal flow may need to get creative, and working with homeowners who recently received a Notice of Default can be a smart strategy.

In this article, we’ll explain what a Notice of Default (NOD) is, how the NOD process works, and how you can use NODs as a lead source for off-market deals and motivated sellers.

Table of Contents |

Definition of a Notice of Default (NOD)

A Notice of Default (NOD) is a formal notice—used in many nonjudicial foreclosure states—that a lender files after a homeowner misses several mortgage payments (typically three or more).

Though related, an NOD is not to be confused with a Notice of Sale (NOS), which often follows the NOD to inform the borrower about when and where the foreclosure property will be sold.

How the NOD Process Works

When a borrower stops making mortgage payments, they’re considered in default. A Notice of Default kicks off the pre-foreclosure period between loan default and the final foreclosure sale. However, in judicial foreclosure states, lenders may file a lawsuit instead of an NOD.

From there, the borrower generally has 30 days to work out a payment agreement with the lender or pay the full owed balance. Otherwise, the lender will proceed to foreclose on the home. All in all, the time between initial default and final foreclosure can last months, if not years. However, foreclosure notice rules and timelines can vary by state.

Why NODs Matter to Real Estate Professionals

As a real estate professional, NODs can point you to motivated sellers. After all, if a homeowner has received an NOD, they may be struggling financially and more open to selling their home as a result. By approaching such homeowners with empathy and tact, you may be able to secure an off-market deal, bypassing the competition that typically accompanies listed homes.

That said, pre-foreclosure properties have their own risks. For example, you often have a limited timeframe in which to get the deal done. Plus, the home may be in poor condition since homeowners who can’t afford their mortgage often stop investing in proper maintenance.

How Agents and Investors Can Use NOD Information

Here’s how to use NOD information effectively:

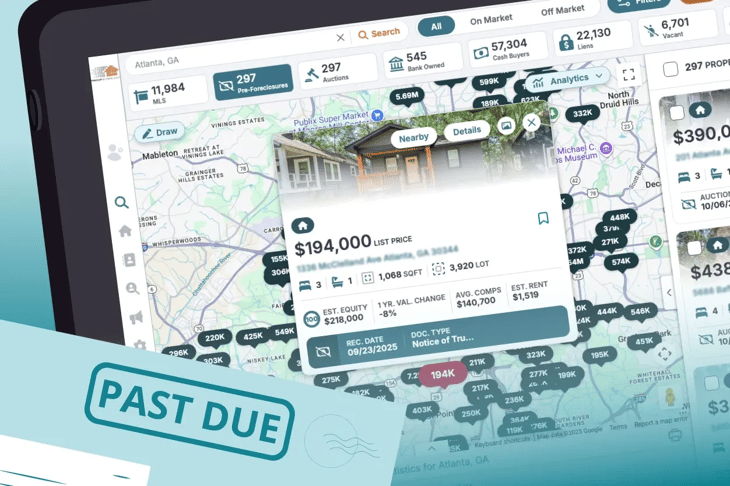

First, search for properties with NODs in public records. You can do this manually by contacting your County Recorder’s or Clerk’s Office, or you can use a tool like PropStream that aggregates data from public records to give you the same information faster and in a searchable format.

Next, build a targeted marketing campaign based on your NOD findings. For example, PropStream lets you skip trace homeowners' contact information and set up postcard or email campaigns. This lets you send tailored marketing messages to motivated sellers, helping you secure a new listing as an agent or a discounted property as an investor.

Tips for Success

Before pursuing NOD leads, here are some best practices to follow:

Stay up-to-date on local laws and regulations

The foreclosure process can vary by state. Confirm that your state requires notices of default and, if so, what the timeline is. Then stay up to date on any changes to foreclosure regulations, so you can optimize your NOI lead generation efforts.

Related: What Is the Difference Between Foreclosure and Pre-Foreclosure?

Use data responsibly to identify leads

While Notices of Default are made public, you should use this information responsibly. This means respecting homeowner privacy and ensuring your marketing complies with all data privacy and consumer protection laws.

Maintain a balance between opportunity and professionalism

Every NOD lead can be an opportunity to secure a property at a discount. However, every NOD lead is also somebody’s home, so be respectful and ethical when contacting its owner. Stay sensitive to their challenging situation and position yourself as someone who can help.

Use PropStream to Identify Homeowners with NODs

Ready to find your next pre-foreclosure lead? PropStream it!

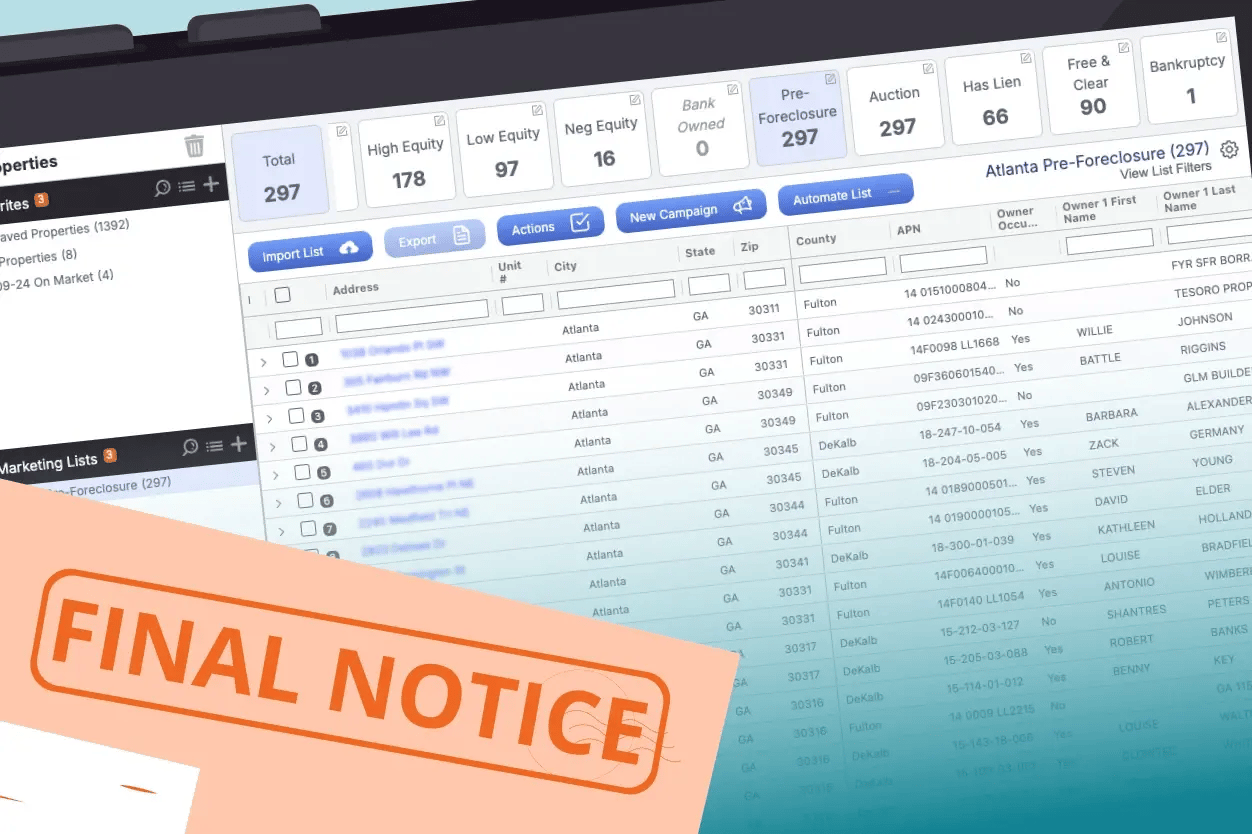

Our real estate database includes a pre-built “Pre-Foreclosures” Lead List that filters out properties that have missed mortgage payment(s) and where a default document has been filed by the lender. Pre-foreclosure document types include Notice of Default, Lis Pendens, Notice of Trustee’s Sale (Auction), and Notice of Sheriff’s Sale (Auction).

All you have to do is select a housing market and then the “Pre-Foreclosures” Lead List from the filter menu. From there, you can stack on additional filters to further narrow your search before saving the lead list and adding it to a marketing campaign.

Find Homeowners with NODs with Propstream.

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

What is a Notice of Default in real estate?

A Notice of Default is a formal document a lender files after a homeowner misses several mortgage payments, officially starting the pre-foreclosure process.

What’s the difference between a Notice of Default and a Notice of Sale?

A Notice of Default alerts the homeowner that they are in default, while a Notice of Sale announces when and where the property will be sold if the mortgage remains in default.

Can a homeowner stop the foreclosure process after receiving a Notice of Default?

Yes, homeowners can typically stop foreclosure by making their outstanding loan payments, negotiating a repayment plan, or selling the property before the foreclosure deadline.

Is it legal to contact homeowners in pre-foreclosure?

It’s generally legal to contact homeowners in pre-foreclosure, as NODs are public records, but outreach must comply with any federal, state, and local marketing and privacy laws.

What are the biggest risks of pursuing Notice of Default leads?

NOD leads may have tight timelines, potential property condition issues, and emotional homeowners, requiring extra care and speed to close a deal.

How can PropStream help me identify and market to Notice of Default leads?

PropStream aggregates NOD data and lets you filter out pre-foreclosure properties, skip trace owner contact info, and launch targeted marketing campaigns—all from one platform.