Try PropStream for 7 Days Free!

Disclaimer: PropStream does not offer investment or legal advice. This article is for educational purposes only. Consult a financial and/or legal professional before buying a condemned house.

|

Key Takeaways:

|

As a real estate investor, you try to buy low and sell high. However, there’s one property type that you can often buy for less than any other: condemned homes. In this article, we’ll explain what they are, the risks they carry, and how to buy, finance, renovate, and flip them for a profit.

Table of Contents |

What Is a Condemned Property?

A condemned property is a home that the government has deemed uninhabitable. This could be because it’s unsafe or violates local building codes. Either way, these properties can’t be used until they are returned to a habitable state (as confirmed by local authorities).

However, this doesn’t mean you can’t still buy condemned properties. It just means that you’ll have some work to do before you can rent them out to tenants or sell them to homebuyers. In some cases, you may even need to tear down the building and build a new home on the lot.

Keep in mind that the rules for condemning and lifting condemnation on properties can vary by city and county. Some jurisdictions enforce stricter procedures and requirements than others.

| Note: Though condemned and vacant properties are related, they are not the same. A vacant property is simply unoccupied, while a condemned property has been officially declared unsafe or uninhabitable by authorities, whether or not anyone currently lives there. |

Legalities and Risks to Consider

Before investing in condemned properties, know the risks and legal implications.

Liability Risks

As the new owner of a condemned home, you may be liable for any safety or health issues it creates for the surrounding neighborhood.

For example, if pests living in the property infest neighboring homes, you could be held responsible. The same goes if someone is injured on the property due to structural damage or exposed hazards.

Potential Liens

If a home is condemned, chances are that it has unpaid bills that have turned into liens.

For example, the property may come with tax and mortgage liens that you must pay off before you can legally transfer ownership or sell the property.

Rehab and Permit Costs

Perhaps the biggest risk of buying a condemned home is overpaying. Beyond the purchase price, you must account for permitting and renovation costs to make the property habitable.

Condemned homes often need major structural repairs, updated utility systems, or the removal of environmental hazards such as asbestos, lead, or mold. In some cases, the property may be so damaged that demolishing and rebuilding it is the only viable option.

In any case, local authorities may require detailed renovation plans showing how you’ll bring the home up to code before approving a sale or issuing construction permits.

| Pro Tip: To estimate renovation costs before buying a condemned property, enter the property details into our Rehab Calculator. |

How to Find Condemned Properties

Assuming you understand the risks involved, here are some ways to find condemned homes:

Public Records

Your county assessor, clerk, or recorder’s office may keep a list of condemned properties. If nothing else, they’ll have information on properties with unpaid taxes, notices of default, and foreclosure filings—some of which may also be condemned.

Check the county’s website first. If the information isn’t available there, you may need to visit the office in person.

Driving for Dollars

Of course, you can always drive around neighborhoods looking for properties with visible signs of neglect (aka driving for dollars). Many condemned properties also have notices posted to them, informing the public that the property is unsafe to occupy.

Networking

Leverage your professional network. Other real estate investors, agents, wholesalers, and attorneys may come across condemned properties and be happy to pass the leads on to you. But you won’t know unless you ask. The same goes for any municipal contacts you might have.

Real Estate Data Platforms

Instead of scouring public records, neighborhoods, or your network for condemned homes, you can also find investment opportunities with real estate data software like PropStream.

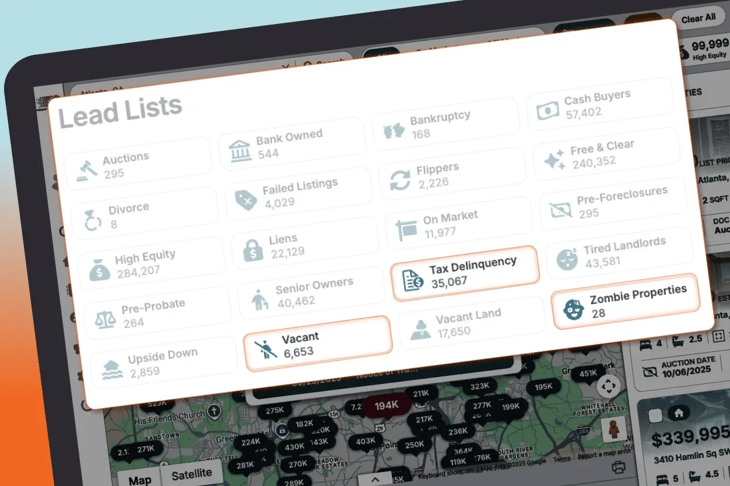

Our platform gives you access to records on over 160 million properties nationwide, with advanced filters to help you locate the ones that are most likely to be condemned. For instance, you can search specifically for zombie, vacant, or tax-delinquent properties.

Inspection and Renovation Planning

Once you’ve found a condemned property you’re interested in, it’s time to do your due diligence.

The first step is to get a professional home inspection. Since the home has a high chance of having major issues, you want to know what they are.

From there, you can start estimating repair costs and building a rehab budget. Call local contractors for quotes to get customized price estimates.

Next, calculate the property’s estimated after-repair value (ARV) to ensure it's worth the investment. This involves determining the property’s current value by analyzing comparable properties that were recently sold (aka “comps”) and then adding the value of renovations.

| Pro Tip: Run accurate comps with PropStream. Our platform automatically pulls up relevant comps for any property to give you its estimated market value. |

Financing and Purchasing Options

Buying a condemned property isn’t like buying a typical home.

First of all, the seller is usually a government agency or bank, which means additional paperwork, approvals, and red tape can slow down the transaction.

Secondly, traditional lenders generally won’t finance a condemned home due to its legal status or poor condition. This leaves you with two main options: pay cash or work with a private lender.

Either way, you may take on more risk—whether by committing more of your own capital or accepting a higher interest rate, which private lenders often charge for riskier investments.

3 Tips for Success

That said, condemned properties can be lucrative investments if you manage the risk right. Here are some best practices to help ensure your condemned home investment is successful:

1. Start Small

Don’t buy too many condemned homes at once. Start with one to learn the ropes. That way, you gain valuable experience to help you improve your next investment.

2. Manage Hidden Costs and Delays

Real estate projects almost always experience unexpected cost overruns or delays. Give yourself some extra time and a financial cushion to account for them.

3. Build a Strong Team

The best real estate investors have a strong team that includes reliable inspectors, contractors, legal advisors, and more. Start building your dream team now.

Find Your Next Distressed Property with PropStream

Condemned homes are among the most overlooked real estate investing opportunities. When properly vetted, restored, and managed, they can deliver strong returns.

What’s more, finding and evaluating these properties is now easier than ever.

With PropStream, you can build a rehab estimate for a property in any condition using the Rehab Calculator. Or, use our Lead Lists to find properties in disrepair with potentially motivated sellers, like: Zombie, Tax-Delinquent, or Vacant properties.

Ready to start uncovering hidden opportunities?

Find Distressed Homeowners Leads with with Propstream.

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

What is a condemned house?

A condemned house is a property that local authorities have deemed unsafe or uninhabitable due to structural issues, code violations, or health hazards.

What happens when a house is condemned?

Once condemned, a property cannot be legally occupied until it is repaired or brought up to code. Notices are typically posted to inform the public of their status.

How do I know if a property is condemned?

You can check public records at your county assessor, clerk, or recorder’s office and look for posted notices on the property.

Can anyone buy a condemned property?

Yes, but buyers must be aware of the legal requirements, potential clients, and the financial and safety risks involved. Some properties may also require special approvals before purchase.

How do you buy a condemned house?

Condemned properties are typically purchased through cash transactions or private lenders, often from government agencies or banks. They always require due diligence.

How can PropStream help me identify and market to Notice of Default leads?

PropStream aggregates NOD data and lets you filter out pre-foreclosure properties, skip trace owner contact info, and launch targeted marketing campaigns—all from one platform.

Subscribe to PropStream's Newsletter