Disclaimer: PropStream does not offer financial advice. This article is for informational purposes only. Consult a financial professional before trying the BRRRR investment strategy.

|

Key Takeaways:

|

The BRRRR strategy was popular in 2021-2022 when mortgage rates were low and homes were appreciating fast. Is it still? The answer is complicated. While BRRRR investors no longer benefit from the same market tailwinds, they can still succeed with the right data and know-how.

Read on to learn what the BRRRR strategy is, how to adapt it to today’s market, and more.

What Is the BRRRR Strategy and Why It Became Popular

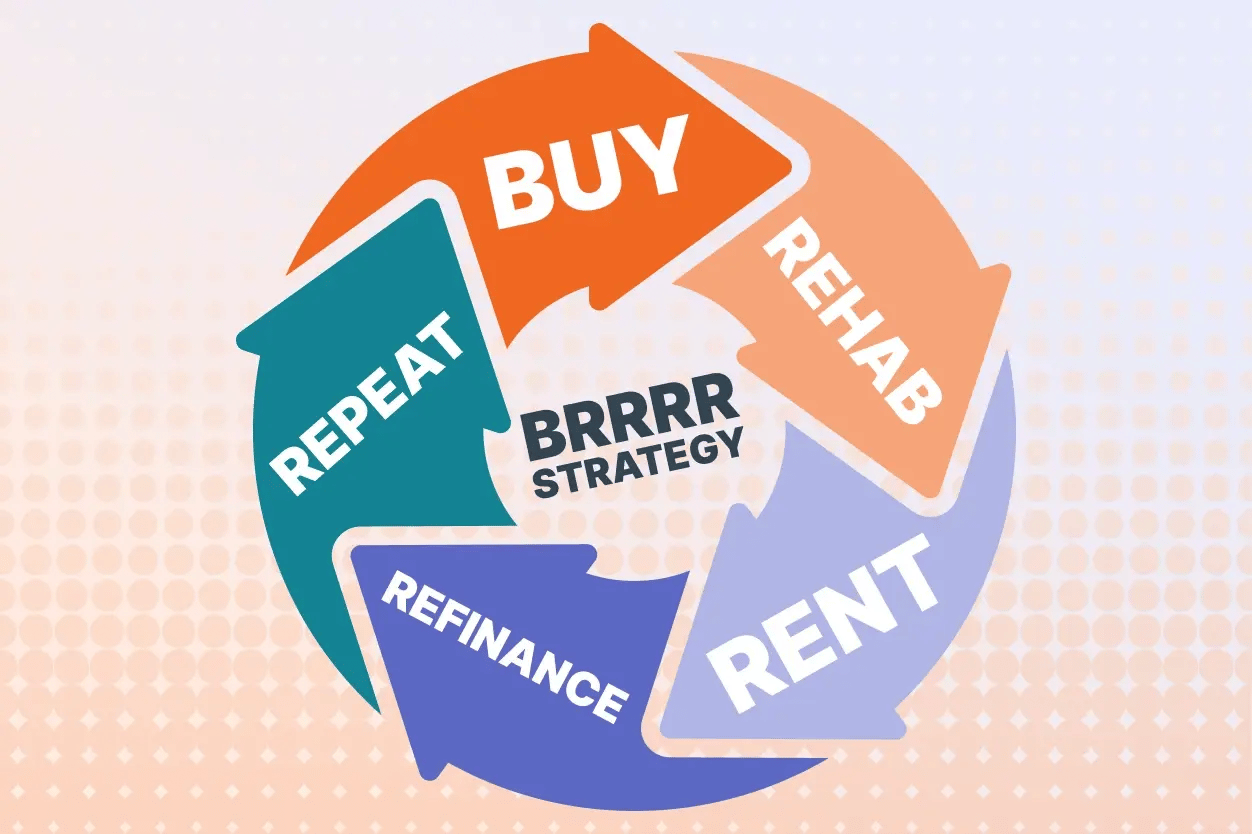

The BRRRR strategy is a popular real estate investing strategy that involves five steps:

- Buy a distressed property

- Rehab the property

- Rent the property to tenants

- Refinance the property to pull out your new equity

- Repeat the process from step one

When mortgage rates were 2-3% in 2021-2022, the cost of financing real estate was relatively low, encouraging the “buy” phase of the BRRRR method. Meanwhile, homes were appreciating rapidly, allowing many BRRRR investors to build positive equity solely from the market. In other words, it didn’t take much skill to make a profit, rinse, and repeat.

Today’s market is different. While the BRRRR strategy can still be a great way to recycle capital and scale your real estate portfolio efficiently, fewer deals pencil out. As a result, understanding how to assess a BRRRR opportunity and having reliable data is more important than ever.

Buy: Finding the Right Properties in Today’s Market

In 2026, buying is arguably the most critical and challenging step of the BRRRR process. This is because investors face lower market appreciation rates (and sometimes even short-term market depreciation), leaving much or all of the equity to be pulled out up to forced appreciation.

In other words, you must buy a distressed property at below market value so that you can add enough value to it via renovations for the investment to be worthwhile. If the rehabbed property appraises low, the equity you can extract later may be limited, making it harder to turn a profit.

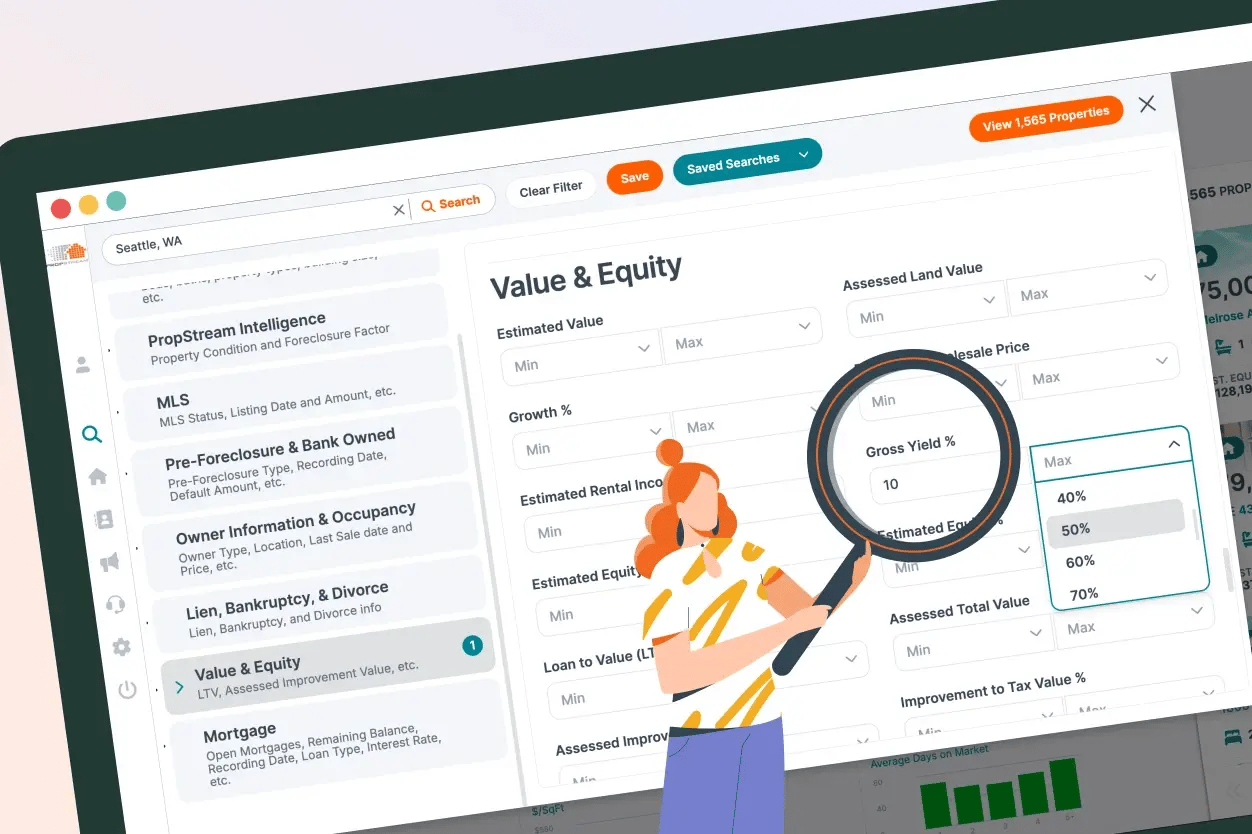

This is where PropStream comes in. It helps you find off-market deals by letting you filter homes by potential selling motivations. For example, you can find properties in poor condition, pre-foreclosure, or tax delinquency, all of which may motivate an owner to sell at a discount.

Pro Tip: Explore PropStream’s 20 pre-built Lead Lists to quickly find BRRRR opportunities.

Rehab: Evaluating Renovation Risk Before You Buy

On top of finding properties below market value, you must accurately estimate rehab costs and timelines. Otherwise, your investment could quickly run over budget and end in a loss.

Since labor and material costs vary by market, gather quotes from local contractors. To see if a deal is even worth exploring, use PropStream’s Rehab Calculator first. Whatever you do, try to avoid scope creep (when you allow the project’s scope to grow beyond your initial plan).

Rent: Assessing Rental Demand and Cash Flow

Your cash-out refinance options depend on your property’s rental performance. In fact, most lenders require a 6-12-month seasoning period where you demonstrate consistent rental income before they’ll approve a refinance.

Imagine you want to conduct a BRRRR in Seattle, Washington. Here, the average monthly rent is $2,228, representing a slight year-over-year decrease. Meanwhile, the county’s rental housing vacancy rate stands at 7.3% as of Q2 2025, compared with 7.0% a year before. With rents stagnant and vacancies growing, now may not be the best time to conduct a BRRRR in Seattle.

However, some Seattle neighborhoods and properties may outperform the rest of the city, which is why granular real estate data from PropStream can be so powerful. It helps you estimate an individual property’s value and rental income so you can make a more informed decision.

Also read: How to Calculate ROI on Rental Property

Refinance: The Biggest BRRRR Bottleneck in 2026

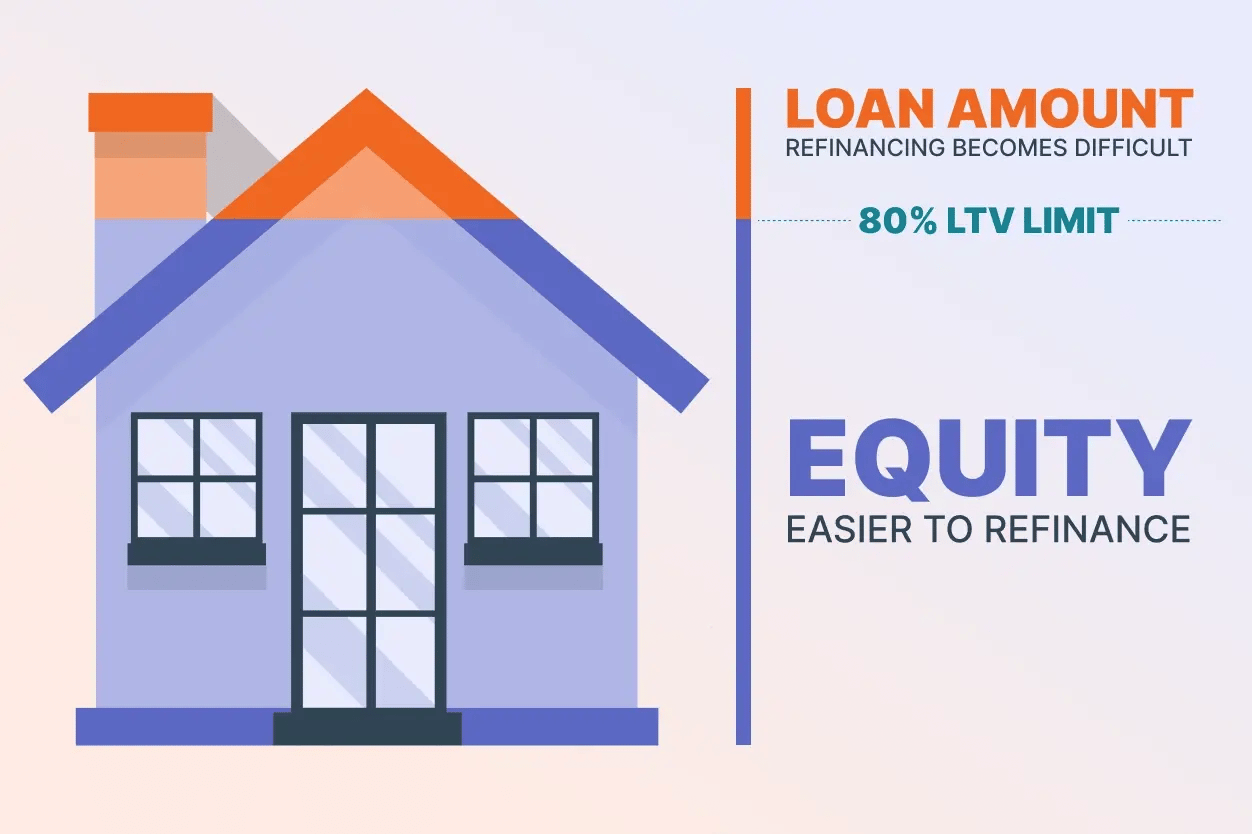

While mortgage rates have trended downward for the last year, they’re still well over the historic lows seen in 2021-2022. As of February 5th, 2026, the average 30-year fixed rate was 6.11%. This increases the cost of borrowing, which limits your financing options for BRRRRs.

For example, a higher interest rate increases your total loan cost and puts pressure on your loan-to-value (LTV). If your LTV exceeds 80%, many lenders won’t lend to you. The same goes if the property’s appraisal comes in low or if it doesn’t meet the lender’s seasoning requirement.

As a result, you should underwrite BRRRR refinancing scenarios conservatively or plan for longer hold periods (giving the property more time to appreciate before applying for refinancing). Additionally, compare how your refinancing options change when you pursue a long-term vs. short-term rental strategy.

Repeat: Is Scaling With BRRRR Still Realistic?

Pulling off a successful BRRRR is an achievement. Doing it again is even more impressive.

While the BRRRR method calls for repeating the strategy indefinitely, this may be more challenging in today’s market. Capital constraints, deal scarcity, and operational complexity can keep you from being able to immediately reinvest your capital into another deal.

That’s okay. Adjust your expectations to current market constraints, but stay ready to seize opportunities when they come.

Is the BRRRR Strategy Still Relevant in 2026 or Has It Evolved?

Ultimately, the BRRRR strategy is still relevant in 2026 because it still works even when there are fewer opportunities. Plus, PropStream can help you find the best deals (before your competition does) with better data, filtering, and data analysis.

In other words, the BRRRR strategy isn’t dead, but it demands smarter execution. Use PropStream today to find better acquisition opportunities, analyze deals with confidence, and adapt your investment strategy for today’s market.

Discover Data-Backed BRRRR Opportunities with PropStream!

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

What is the BRRRR strategy in real estate?

In real estate, the BRRRR strategy stands for buy, rehab, rent, refinance, repeat. It’s a real estate investing approach that involves buying distressed property, renovating it, renting it to tenants, refinancing it to pull out equity, and repeating the process to scale your portfolio.

Is the BRRRR strategy still viable in 2026?

Yes, the BRRRR strategy is still viable in 2026, but it requires more careful analysis and execution than in previous years. With higher interest rates and slower appreciation, investors must focus on finding better deals, accurately estimating rehab costs, and planning for longer hold periods before refinancing.

What are the pros and cons of the BRRRR method?

The pros of the BRRRR method include the ability to recycle capital and scale quickly, force appreciation through renovations, and build long-term rental income. The cons include higher refinancing costs due to elevated interest rates, increased difficulty finding deals that pencil, and operational complexity from managing renovations and tenants.

How does BRRRR investing work in today’s market?

BRRRR investing in today’s market requires more conservative underwriting and reliance on forced appreciation rather than market appreciation. Investors must buy properties at deeper discounts, carefully manage rehab budgets, and be conservative in underwriting refinances.

What are some alternatives to the BRRRR strategy?

Alternatives to the BRRRR strategy include traditional buy-and-hold investing, house flipping, wholesaling, short-term rental investing, and real estate syndications. Each strategy has different capital requirements, time commitments, and risk profiles that may better suit certain market conditions or investor goals.

What BRRRR tips should new investors know?

Our top BRRRR investing tips include the following: start with accurate market research using tools like PropStream, get multiple contractor quotes to avoid budget overruns, understand local rental demand before buying, build relationships with lenders who understand the BRRRR method, and avoid scope creep during renovations to protect your profit margins.

How does PropStream help you find free-and-clear leads?

PropStream provides a dedicated Free & Clear Lead List with nationwide coverage of over 160 million+ properties and regularly updated ownership and mortgage data. With it, you can quickly filter for free and clear properties in your preferred area, skip trace contact information, Click-to-Dial, and launch marketing campaigns—all within the same platform.

Subscribe to PropStream's Newsletter