Disclaimer: PropStream does not offer legal advice. This article is for informational purposes only. Consult a legal professional before contacting homeowners with free and clear mortgages.

|

Key Takeaways:

|

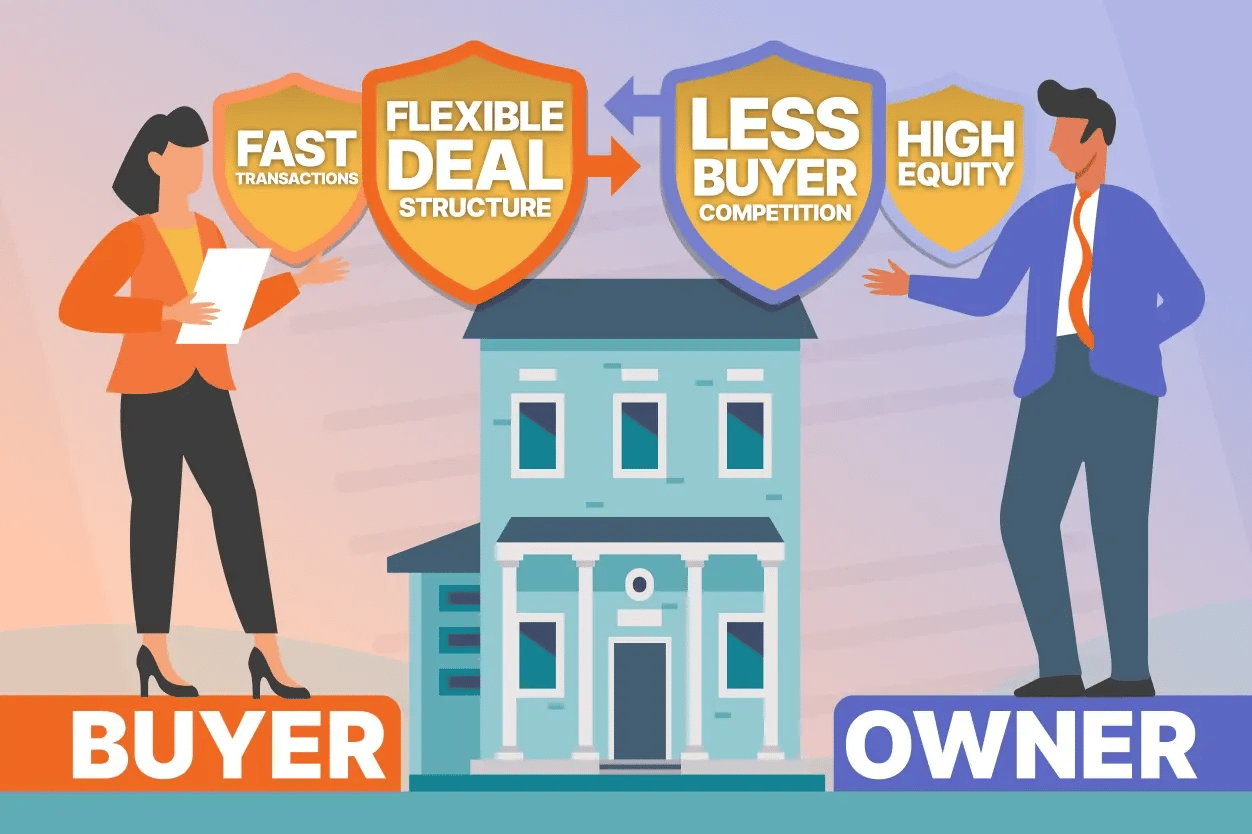

Owning your home free and clear can be a great feeling. It means you no longer have a mortgage to pay. However, this is also useful information for real estate investors and agents, pointing toward deals with more negotiation flexibility, speed, and creative financing options.

In this article, we’ll go over what “free and clear” means, what makes free and clear properties valuable leads for investors and agents, and how to find free and clear homes with PropStream.

What Does “Free and Clear” Mean in Real Estate?

In real estate, free and clear means there’s no remaining mortgage or lien tied to a property. In other words, the property is owned outright, free of obligations to creditors (though the property is still subject to property tax).

By contrast, high equity properties are those where the owner has paid off a large portion of the property’s value but still carries a mortgage on the remainder. Think of these as soon-to-be free and clear properties if the homeowner continues to make their mortgage payments on schedule.

Why does ownership status matter to investors? It signals the potential for faster, simpler transactions. Since free and clear properties aren’t encumbered by mortgages, there’s no need for sellers to coordinate payoffs with lenders.

How Free and Clear Properties Differ From Mortgaged Homes

Let’s dive deeper into what makes free and clear properties unique from mortgaged homes.

Most mortgages have a due-on-sale clause, which gives a lender the right to demand the borrower repay any remaining loan balance when they sell or transfer the property. This introduces lender approvals, payoff timelines, and other constraints into the transaction.

Free and clear homes bypass these complexities, allowing the sale to move faster with fewer complications. In short, the seller has more flexibility over when and how they sell the home.

For instance, free and clear sellers don’t have a mortgage payoff dictating their minimum price. They can accept any offer that makes financial sense to them, even well below market value. By contrast, owners with a mortgage must sell for at least enough to pay off their loan.

Why Free and Clear Property Owners Are Valuable Leads

That said, free and clear homeowners can make attractive leads for additional reasons.

On top of not being subject to loan pressure, free and clear homeowners’ high equity positions can make them open to creative deal structures. For example, you may be able to arrange a seller financing deal, in which the seller serves as your lender. That way, you don’t have to secure traditional financing, and you can take advantage of more flexible loan terms.

Additionally, agents may be attracted to seller leads with free-and-clear homes, as these tend to sell with fewer complications and are less likely to fall through.

The truth is, free and clear homeowners are often overlooked as leads because they usually aren’t distressed. But even without obvious signs of selling motivation, they may be very eager to accept the right offer at the right time, and you may not face as much buyer competition.

How PropStream Helps Identify Free and Clear Homes

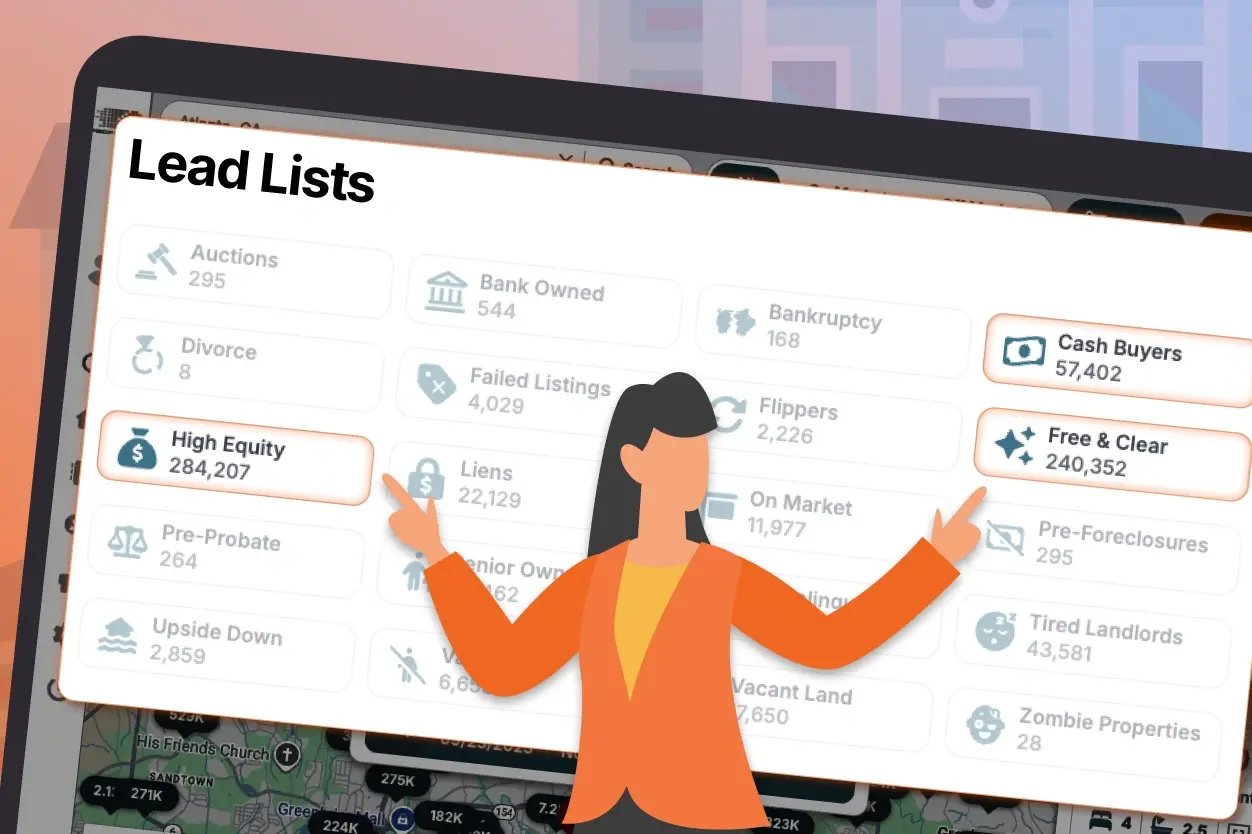

Fortunately, you don’t need to manually analyze mortgage balances property by property to identify free and clear homes. You can simply use PropStream’s Free & Clear Lead List.

Our platform has nationwide coverage of over 160 million properties, and we regularly update their ownership and mortgage data. By applying the free & clear search filter, you can quickly find the properties in your preferred market that are owned outright.

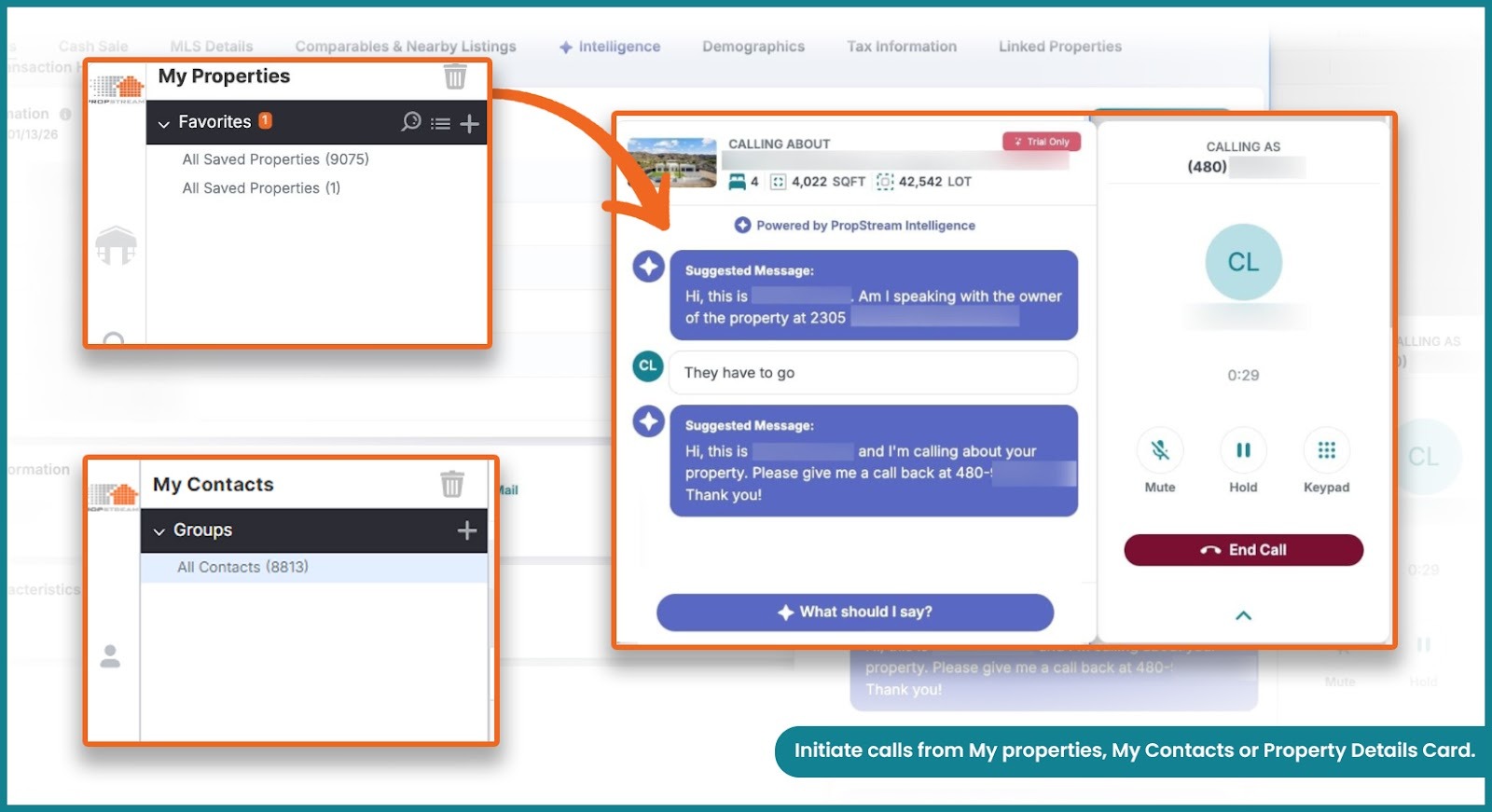

Once you’ve identified the right prospects, you can skip-trace their contact information and take action immediately. Click-to-Dial allows you to place one-to-one calls directly from PropStream, making it easy to follow up while property details are still fresh. You can also launch email or postcard campaigns from the same workflow, helping you move from research to real conversations without switching tools.

Refine Free & Clear Lead Lists to Find Local Hidden Opportunities

To narrow in on even higher quality leads, stack additional filters onto your search.

For example, on top of the free and clear filter, you could layer on filters for long ownership, absentee owner, vacant property, or a specific property type. Each of these can signal selling motivation beyond high equity or help you focus on a specific property type. The result will be an even more focused list, potentially improving lead quality and conversion rates.

Pro Tip: Filter and list stacking is an art. Learn more about it and how you can use it to your advantage by reading our article on the subject.

How Investors and Agents Use Free and Clear Leads

Free-and-clear leads can be used in many ways. Consider the following:

|

Investors looking for quick cash deals |

Free-and-clear properties allow investors to close faster because there’s no need to coordinate with lenders. |

|

Wholesalers structuring creative agreements |

Without mortgage constraints, wholesalers have more flexibility to structure deals like lease options or seller financing. |

|

Agents identifying sellers without payoff pressure |

These sellers aren’t forced to hit a minimum price to satisfy a mortgage, giving agents more room to negotiate. |

Ultimately, free-and-clear leads can mean faster negotiations, flexible pricing, and smoother closings. But first, you must find them. To get a head start, try PropStream!

Use our Free & Clear Lead List today to identify high-equity property owners, refine your outreach, and create more flexible deal opportunities moving forward.

Find Your Next Real Estate Deal With PropStream.

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

What does free and clear mean in real estate?

In real estate, free and clear means a property is owned outright with no mortgage, lien, or other debt attached to it (except the obligation to pay property tax).

How are free and clear homes different from those with mortgages?

Free and clear homes have no mortgage payoff requirements needed for sale, giving sellers complete pricing flexibility. By contrast, mortgaged homes must sell for at least enough to cover the remaining loan balance (plus closing costs).

What are the benefits of focusing on free and clear leads?

Free and clear leads can offer faster transaction timelines, more flexible pricing negotiations, and opportunities for creative deal structures like seller financing.

Are free and clear leads more likely to sell than other lead types?

Not necessarily. However, they have more flexibility in accepting offers since they’re not constrained by mortgage payoff requirements. Plus, the transaction tends to move faster.

How can I find free-and-clear homes in my market?

You can find free and clear homes using tools like PropStream’s Free & Clear Lead List, which identifies properties without mortgages across your preferred market.

Can I contact Free & Clear homeowners directly from PropStream?

Yes. After identifying Free & Clear properties and skip tracing contact details, you can reach out directly from PropStream using Click-to-Dial for quick, one-to-one phone conversations.

How does PropStream help you find free-and-clear leads?

PropStream provides a dedicated Free & Clear Lead List with nationwide coverage of over 160 million+ properties and regularly updated ownership and mortgage data. With it, you can quickly filter for free and clear properties in your preferred area, skip trace contact information, Click-to-Dial, and launch marketing campaigns—all within the same platform.

Subscribe to PropStream's Newsletter