Disclaimer: PropStream does not offer legal advice. This article is for informational purposes only. Consult a legal professional before contacting or advising bankrupt homeowners.

|

Key Takeaways:

|

Bankruptcy filings are public record, but knowing when a bankrupt homeowner has mentally shifted from “saving the house” to “ready to sell” requires reading between the lines.

Real estate agents who learn to step in at just the right moment can educate bankrupt homeowners on their selling options and potentially secure a new listing. However, it requires an ethical approach that puts the homeowner’s best interests first.

Table of Contents |

What Are Bankruptcy Leads in Real Estate?

In real estate, bankruptcy leads are homeowners with an active bankruptcy filing who may want or need to sell to relieve their debt. Since home equity accounts for a major portion of many American households’ wealth, some owners may be required to sell as part of their bankruptcy proceedings, depending on the type of bankruptcy and any state exemptions.

However, not all bankrupt homeowners are forced to sell. Many choose to sell voluntarily to avoid foreclosure, downsize to a more affordable home, or gain a fresh financial start by liquidating their home equity to pay off creditors and reduce their liabilities. Either way, bankrupt homeowners can be valuable leads for agents.

Why Bankruptcy Leads Are Valuable for Agents

Here are the main benefits of working with bankruptcy leads:

- High motivation to sell. Bankrupt homeowners can use home sale proceeds to pay off debts, but must move quickly to meet bankruptcy proceeding deadlines.

- Less competition. Many agents avoid bankruptcy leads due to their complexity, meaning less competition for those willing to work with these clients.

- Opportunity for multiple transactions. After selling, these homeowners often need to buy or rent a new home, creating potential for additional transactions and commissions.

- Helping clients in genuine need. These homeowners face real financial hardship that requires professional guidance. As a result, working with them can be extra fulfilling.

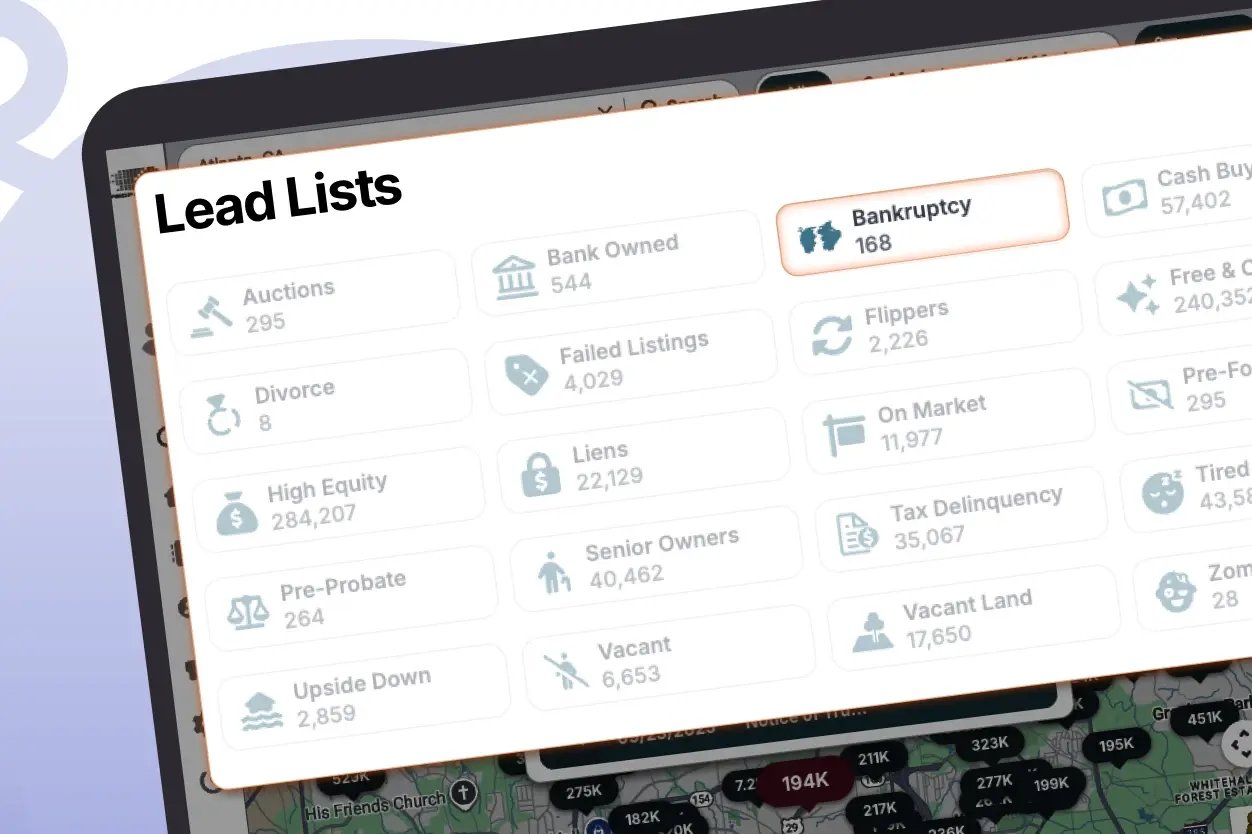

Pro Tip: Search for bankruptcy leads in your market with PropStream’s Bankruptcy Filter and dedicated Lead List.

The Top 10 Signs a Bankrupt Homeowner May Be Ready to Sell

Now that you know why bankrupt homeowners can make good leads, let’s explore the signs that they may be ready to sell their home:

Missed mortgage or utility payments

When homeowners fall behind on mortgage payments or utility bills, it signals financial distress and potential willingness to explore selling before the situation worsens.

Property listed as delinquent or pre-foreclosure

A property in pre-foreclosure status means the lender has started the foreclosure process, putting pressure on the homeowner to sell quickly and potentially salvage their credit and equity.

High equity despite financial strain

Homeowners with high equity but mounting debts can be great leads since they may have the financial cushion to sell quickly at a fair price to pay off creditors.

Recent court filings involving debt restructuring

Fresh bankruptcy filings indicate the homeowner is actively trying to resolve their debts. As a result, they may be more open to selling their home as part of that process.

Reduction in property maintenance or occupancy

Visible neglect, such as overgrown lawns or peeling paint, and signs of vacancy may suggest the owner can no longer afford the home and is ready to move on.

Listing withdrawn or expired after a failed sale attempt

A previous unsuccessful listing shows the owner already tried to sell but faced challenges, such as poor pricing, marketing, or timing. As a result, they may now be more motivated to work with an agent with a strong track record.

Owner communication showing openness to “creative solutions.”

When homeowners respond to outreach with phrases like “I’m open to exploring my options,” they’re signaling flexibility and willingness to explore a sale.

Repeated refinancing or loan modification attempts

Multiple attempts to refinance or modify their loan may demonstrate that the owner has been struggling to keep the property for some time. Selling may be their best remaining option.

Divorce or job loss is tied to the bankruptcy case

Life-changing events such as divorce or unemployment often exacerbate the need to sell. For example, former spouses may want to split a home’s equity by selling.

Contact responsiveness, when owners start engaging with outreach

The moment a previously unresponsive homeowner starts returning your calls, opening emails, or asking questions is a critical signal. It may show they’ve shifted from denial to action and are now actively seeking solutions to their financial crisis.

How Agents Can Ethically Engage Bankruptcy Leads

.webp?width=1252&height=834&name=propstream-blog-inline-image-top-10-signs-bankrupt-2-1252x834%20(1).webp)

When engaging bankruptcy leads, maintain the highest ethical standards. Here’s how:

Lead with empathy. Bankruptcy can be a major challenge that affects homeowners financially and emotionally. Express your sympathy for their situation and position yourself as someone who can help.

Educate on selling options. Instead of immediately pitching your agent services, clarify what the homeowner’s selling options are during or after bankruptcy. The more owners know, the better positioned they are to make an informed decision.

Never pressure. Bankrupt homeowners are in a vulnerable position that calls for sensitivity, not pressure. Build trust by offering useful information and letting homeowners make their own financial decisions.

Pro Tip: In addition to identifying bankruptcy leads, PropStream enables you to analyze ownership, lien, and equity details to help you qualify prospects. From there, you can skip trace for their verified contact information and launch direct mail or email marketing campaigns, all on one platform!

5 Tips for Converting Bankruptcy Leads into Listings

To turn bankruptcy leads into listings, follow these best practices:

Always verify data accuracy before outreach

Bankruptcy records can contain outdated contact information, incorrect property details, or cases that have already been resolved. Take a few minutes to cross-reference records to ensure you’re not wasting time on dead leads.

Highlight your expertise in handling sensitive sales

Bankrupt homeowners need an agent who understands court approval processes and timelines that typical agents may not. Position yourself as an expert by doing your research and showcasing any success stories with past bankruptcy clients.

Offer free home valuations or market comparisons

Many bankrupt homeowners may not know their home’s current value and whether selling makes financial sense. Provide a no-obligation valuation or comp analysis to show good faith and demonstrate your ability to help them understand their options.

Follow up respectfully and consistently

Bankruptcy is an emotionally charged process, and homeowners may not be ready to engage when you first contact them. However, consistent and respectful follow-up can open the door to further conversation if and when they’re ready to explore their selling options.

Use PropStream to track lead updates and new filings automatically

Manually monitoring bankruptcy filings can be time-consuming and prone to missed opportunities. But after using the dedicated bankruptcy lead list on PropStream, you can be automatically notified anytime new leads meet your list criteria, so you don’t miss a beat reaching out to them.

Ultimately, bankruptcy filings can be a great lead source for agents because they can reveal homeowners who are truly ready for a change. With PropStream, you can identify, research, and reach motivated sellers with accurate data and ethical outreach tools all on one platform.

Find Your Next Opportunity With PropStream Today!

Sign up for a free 7-day trial today and get 50 leads on us!

Frequently-Asked Questions (FAQs)

Can bankrupt homeowners legally sell their property during bankruptcy proceedings?

Yes, but bankrupt homeowners typically need court approval before selling. Real estate agents should advise clients to consult with their bankruptcy attorney before listing.

How do bankruptcy leads differ from other distressed property leads?

Bankruptcy leads are motivated sellers subject to strict legal timelines and requirements, while other distressed property leads may have more flexibility in their selling timeline and don’t always require court approval for the sale.

How can PropStream’s lead lists help me find bankruptcy leads?

PropStream lead lists let you filter properties by their owners’ bankruptcy status, equity position, and other criteria. From there, you can skip trace their contact information and launch direct mail or email marketing campaigns to reach out to them.

How long should agents wait before contacting someone after a bankruptcy filing?

Waiting 30-60 days after the initial filing is a good rule of thumb, as it gives property owners time to consult with attorneys and process the initial emotions involved. The key is showing empathy regularly and respectfully following up.

What happens to home equity when selling after bankruptcy?

When selling after bankruptcy, any equity beyond mortgage payoff and exemption limits may go toward paying creditors.

Are bankruptcy leads worth pursuing for new real estate agents?

While bankruptcy leads can be valuable leads, they require sensitive communication and understanding of court processes. New agents should educate themselves thoroughly before pursuing bankruptcy leads to ensure they can serve these clients ethically and effectively.

Subscribe to PropStream's Newsletter

*PropStream engages an independent third party to perform skip-tracing.